The crypto market has been steadily expanding basically since its emergence. It started in 2009 with the development of bitcoin, and to this day there are a lot of people out there who think that the whole crypto field is simply “something with bitcoins”.

Of course, the reality is different, and the public perception is gradually changing as well. The introduction of new concepts into crypto technology, such as NFTs, has opened new ways to make money on crypto and brought it closer to the mainstream. Moreover, the number of altcoins has grown to more than 10,000, with new ones being created every day.

Such a rapidly developing market naturally generates big investment opportunities. The relative volatility and instability make the crypto market risky, but also potentially very rewarding. You’ll just have to be careful, extremely well-informed, and persistent. Here are the main methods you can use to make money in the crypto field.

How to make money with cryptocurrencies?

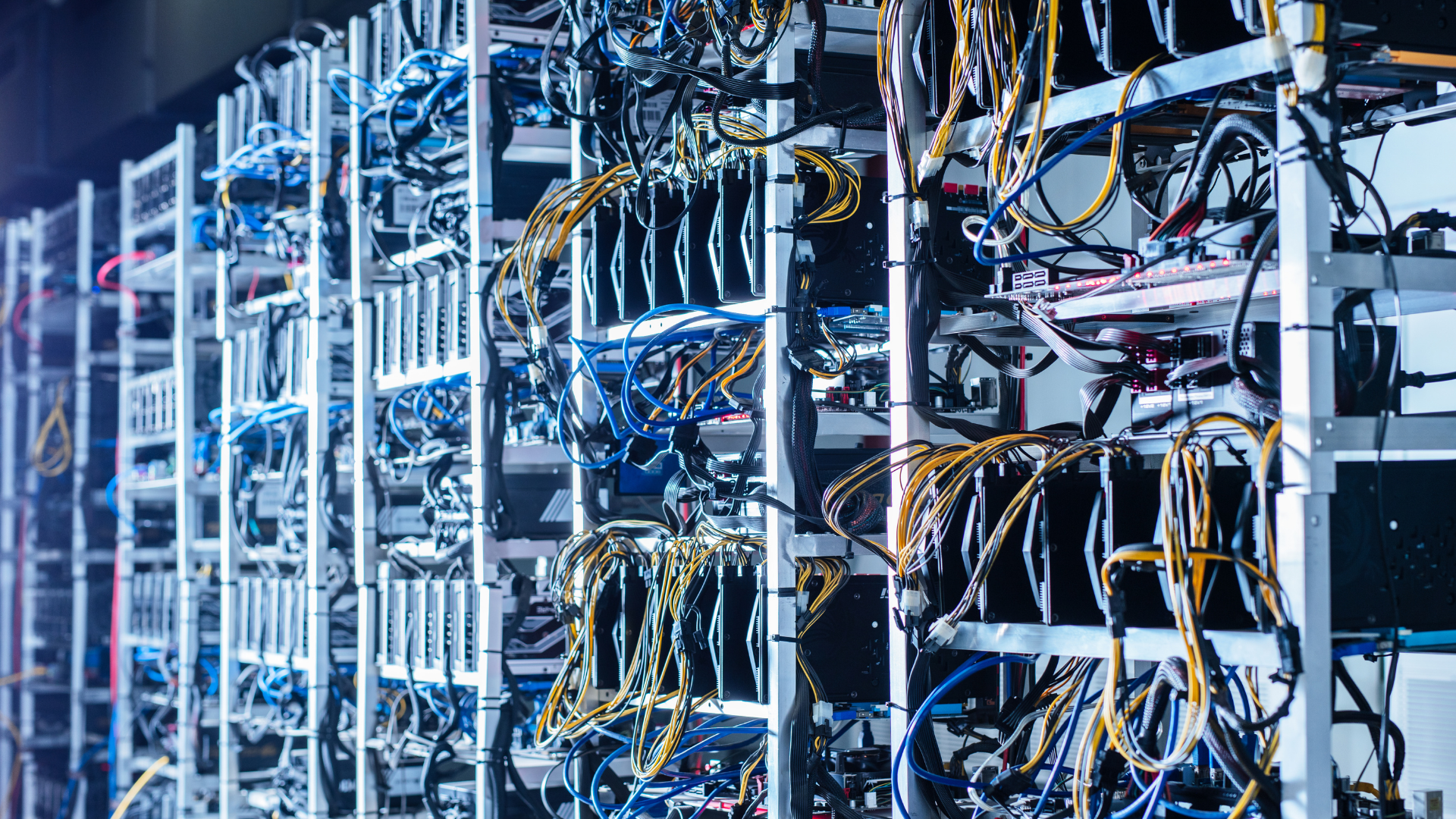

Crypto mining

One of the ways you can make money on cryptocurrencies is mining. In essence, mining represents the process of verification of crypto transactions on proof-of-work blockchains. The process is highly technical, but we’ll try to explain how it works in the simplest possible terms.

A blockchain is a huge (and always growing) ledger with a record of all the crypto transactions ever made on a certain network. It’s decentralized, meaning that its processing power comes from distributed nodes rather than a central server. All the node computers are involved in the verification process based on consensus – if 51% of them “agree” that a transaction is valid, it gets officially confirmed.

This is what keeps the blockchain secure and credible. The nodes – basically powerful GPU or ASIC units – lend the processing power to the chain and do their “police work” in order to get rewarded in crypto coins by the network. However, earning these coins is not easy at all.

Most proof-of-work blockchains use a very complex reward system that rewards only one miner per block of transactions. For instance, it takes 10 minutes for the bitcoin blockchain to produce a block of transactions, and only one out of estimated 1 million miners gets compensated for validating the block. The more processing power you own, the bigger the chances that you’ll be that one. In the case of bitcoin, the prize for one block is currently 6.25 bitcoin, which is almost $250,000, but it’s almost impossible to earn that reward as an individual with your own equipment.

Thus, if you wish to make money by mining, you should probably try joining a mining pool. Miners tend to join their resources and processing power to increase their chances of getting rewarded, splitting the crypto coins they earn among the members of the group.

Cryptocurrency trading

Probably the most common method you can use to make money in crypto is crypto trading. It’s more-less like trading on Forex or on a stock market – you basically just choose a crypto exchange platform, buy some cryptocurrency and you’re all set.

What’s different though is that crypto trading offers a secure, anonymous, and decentralized way to trade and earn money, without any external influence of banks, governments, or any middlemen. In other words, the network is completely self-reliant.

Obviously, you shouldn’t get into crypto trading without knowing the inner workings of the cryptocurrency market and the technology that hosts it. So if you want to get into this, you’ll need a lot of research and everyday commitment. For now, let’s just take a look at the pros and cons of the two basic approaches in crypto trading.

1. Buy-and-hold strategy

Some crypto traders choose to go for the long haul. In this case, it makes sense to go for the most widespread cryptocurrencies such as BTC or ETH as there are fewer potential surprises and you can reasonably expect them to be relatively stable long-term. Most traders and crypto experts expect the market to further grow and cryptocurrencies to gain more prominence as a payment method.

If this happens, then it’s sensible to say that current market leaders are the safest bet. Of course, this doesn’t mean that “smaller” currencies won’t increase in value, but you’ll have to carefully research them and find solid reasons for their future growth.

2. Day trading

Unlike a regular stock market, the crypto trading market is open 24/7. This kind of ruins the point of “day” in “day trading”, but nevertheless there are traders who don’t like to hold onto their crypto assets for long and constantly try to find cryptocurrency pairs that will bring them some quick money.

This strategy demands even more research and experience and it can get very stressful. However, the crypto market is highly volatile, so it does make sense to try to profit on quick, large oscillations that happen commonly. Day traders will thus normally look for currencies that are sufficiently liquid and unstable so they can react promptly when their chance arises.

Note: if you plan to start trading, you should definitely use digital technology that can help you make the right decisions. There are dozens of trading platforms and crypto bots that you can use to thoroughly analyze the market and automate your further actions.

Staking your crypto coins

Apart from the proof-of-work, there are blockchains that use another mechanism to validate transactions, and it’s called proof-of-stake (PoS). Proof-of-work (PoW) technology relies on limits in processing power as a safeguard – in order to hack it, you need to control 51% of all processing power on the network, which would be enormously expensive.

However, PoW systems are quite inefficient and energy-consuming. That’s why some blockchains are using PoS, where nodes that are involved in validation don’t solve complex mathematical problems to compete for block validation but are instead chosen randomly by the network.

Nevertheless, to qualify as a validator at all, you need to own and lock a substantial amount of crypto funds, which will be used as a safeguard and as collateral if you decide to play against the rules. This approach is basically as secure as PoW, but in order to have a chance to hack a PoS system, you don’t need 51% of processing power, but instead 51% of all coins of a certain currency.

And once you decide to stake your coins, you’ll get the right to validate transactions and you’ll get rewarded for doing so. The amount of money you have to stake and the amount of money you’ll earn depends on the currency of your choice and the blockchain it uses. In general, you’ll need a lot of coins if you wish to go down this road. For instance, on the Ethereum blockchain, you need 32 ETH to start staking, which is currently equivalent to more than $80,000. So this is definitely not a strategy for beginners.

How to make money on NFTs?

NFTs are another way to make money in the crypto sphere. Essentially, they’re not a cryptocurrency, but they use the same blockchain technology and are bought and sold for cryptocurrency.

In short, NFTs are tokens on a blockchain that represent a certain digital file, usually a piece of digital art. An NFT is considered proof of ownership of a digital item and is generally recognized as a solution for the future when it comes to trading digital art. For more details, take a look at one of our articles about NFTs.

There are basically three ways to make money on NFTs. Let’s check them in more detail.

Create and sell NFTs

Making money from digital art has always been tricky. The fact that it’s so easily reproducible and downloadable has been quite an obstacle for digital artists who’ve had a hard time charging for their work.

So if you’ve ever been into digital art and you think some of your work would do well on a broad, global market, NFTs might be for you. Creating NFTs is quite easy and straightforward. Most online marketplaces that sell NFTs also offer their users to create, or “mint” one. Depending on the marketplace, this process can get costly, but some of them have very reasonable prices. However, the price itself depends on a number of factors and varies over time, so you’ll have to check the fees and compare them before you start minting.

In any event, spending a few dozen or even a few hundred dollars to mint an NFT can pay off in the long run. The competition is fierce and it’s not easy to get noticed, but the NFT market is absolutely huge at this moment and some of the NFT artwork recently sold have made their creators wildly rich. For instance, the two arguably most famous NFT artist, Pak and Beeple, sold their most expensive pieces in 2021 for $91 million and $69 million respectively!

Enter the NFT trading business

Of course, it’s not only artists who make money on art – this goes for traditional, digital, and NFT art alike. If you think you have a talent to recognize unique and rare pieces of high-quality art, maybe it’s time to try NFT trading. Of course, some additional knowledge about the crypto market and technology also won’t hurt you.

Now, the NFT market grows in demand every day, but the supply is also rapidly growing. More and more people are producing their own NFTs, trying to find their place on the market. Thus the job of an NFT trader is not simple – the popular NFT collections and projects are already very expensive. So in order to make a solid profit on NFT trading, you’ll have to find some of the less popular, but highly promising artists and jump on their bandwagon before all the others.

There’s no recipe for success when it comes to NFT trading, but there are some indicators that can help you find the potentially profitable ones. You should always check their sales history, try to find out more about the artist and their past/future projects, and take a look at their community to gain as much insight as possible and make truly informed decisions.

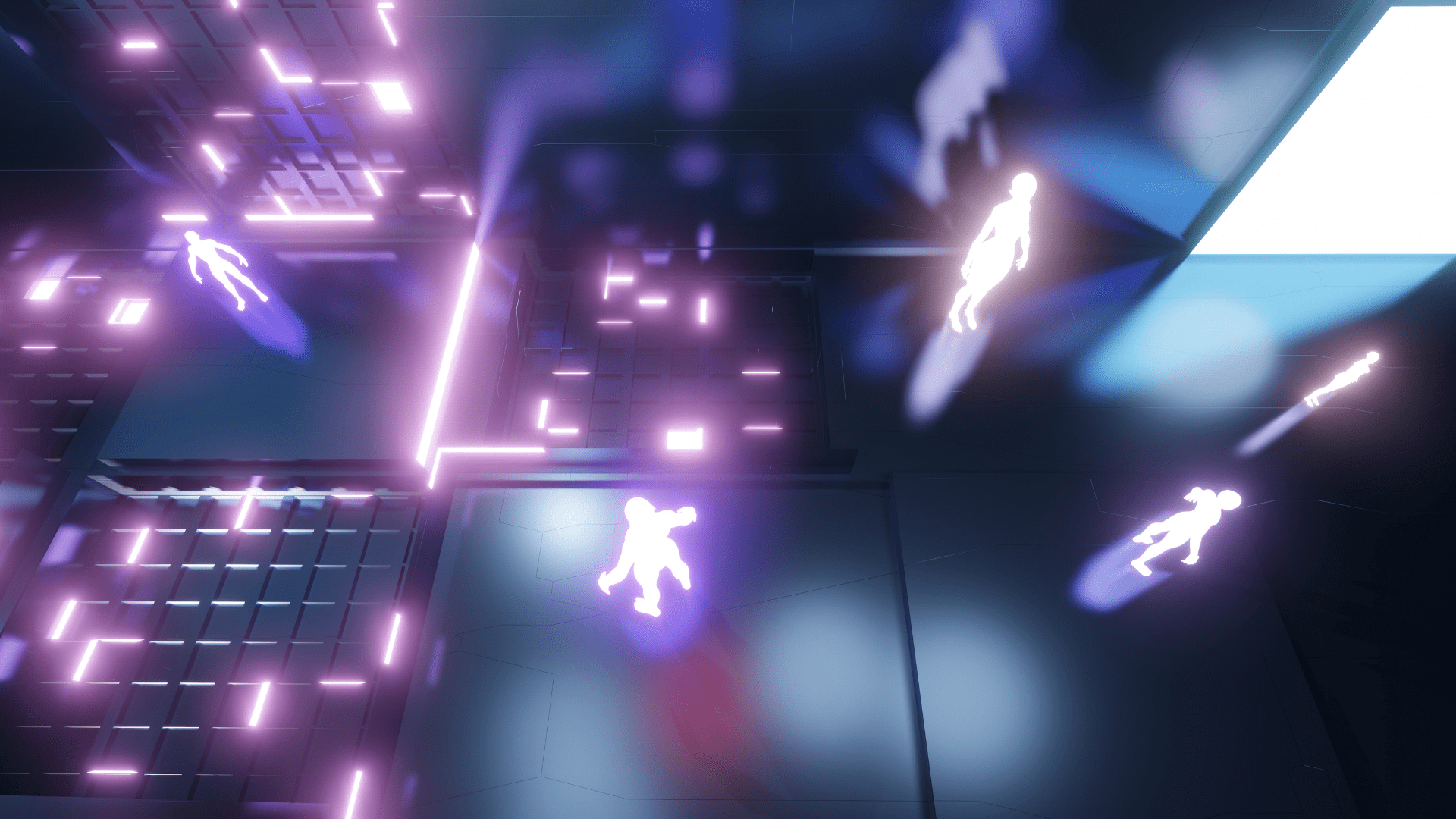

Play NFT games

These NFTs can have another use – they can be employed in video games. If you think about it, every in-game item, such as a weapon, armor, or skin, is a piece of digital art. And the technology behind the NFTs ensures that these items can be transferred between different games and effortlessly sold on marketplaces.

Of course, you can’t just import NFTs into any game you’d like. This works only for games running on a blockchain. In recent years, these NFT games (also called blockchain games, play-to-earn games, or even crypto games) are becoming increasingly original and popular. Some of them look like good old arcade PvP battle games, while other games are massive and expensive metaverse projects with huge open worlds whose economy runs entirely on NFTs. In both these types of games you’ll have a chance to earn some money.

There are several ways you can make money while playing NFT games. Here are some of them:

- You can buy and sell NFTs representing in-game items or characters. You can also boost the character, avatar, or even a pet by gaining experience points or winning battles to increase their value and sell them for more money.

- Farming a certain in-game resource and then selling it as an NFT to another player

- Winning contests or topping leaderboards – some games (such as Solchicks, our latest play-to-earn game) will reward you for winning a competition or for having a really successful week.

- Completing tasks is another way to earn some money in crypto games. Oftentimes games will offer you to complete daily or weekly quests and reward you with their native crypto coin.

Final thoughts

To conclude, there’s a whole array of money-making opportunities in the crypto world. For years, there have been speculations that the demand for crypto will wane and that the “crypto bubble” will soon burst.

However, we’re still not seeing that happening. The market is volatile and unstable, but we never see any long-term shrinkage. On the contrary, it’s growing and getting more flexible and resilient. And with the further digitalization of different spheres of our lives, it’s reasonable to believe that this trend will persist in the years to come.

FAQ – how to make money in crypto?

How much to invest in crypto to make money?

This depends on many factors, but the crucial message to remember is to never invest more than you can lose.

How to make fast money in crypto?

Making fast money in crypto is very unlikely unless you can make a large initial investment, which is extremely risky. Whoever promises you fast and easy profit is probably a fraud. Day trading or NFT trading can bring you some really quick money though, but only if you have extensive knowledge of the market and quite a bit of luck.

When does crypto market close?

Basically never. Unlike a regular stock market, it’s open 24/7 which makes crypto trading more dynamic, but also more stressful at times.

What does market cap mean in crypto?

A market cap is a product of the total number of coins of a certain kind and the current price of that coin. For years, bitcoin has been the leader in this category, followed by ether and the most popular stablecoin – tether.

How to start crypto mining?

To start crypto mining, you’ll first need some mining hardware. This hardware has truly evolved over the years. Back in the days, miners would try to increase the computing power with powerful GPUs, but now you’ll probably go for an ASIC (application-specific integrated circuit) miner. These circuit chips can be quite expensive and the amount of energy they consume is massive. Mining can be a large investment, but the rewards from it are also potentially quite lucrative.